NY UD-8 2014-2025 free printable template

Show details

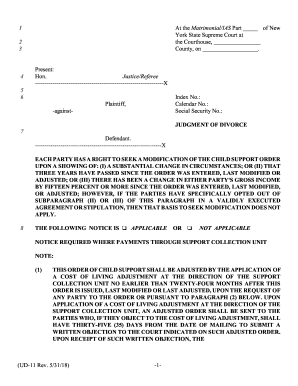

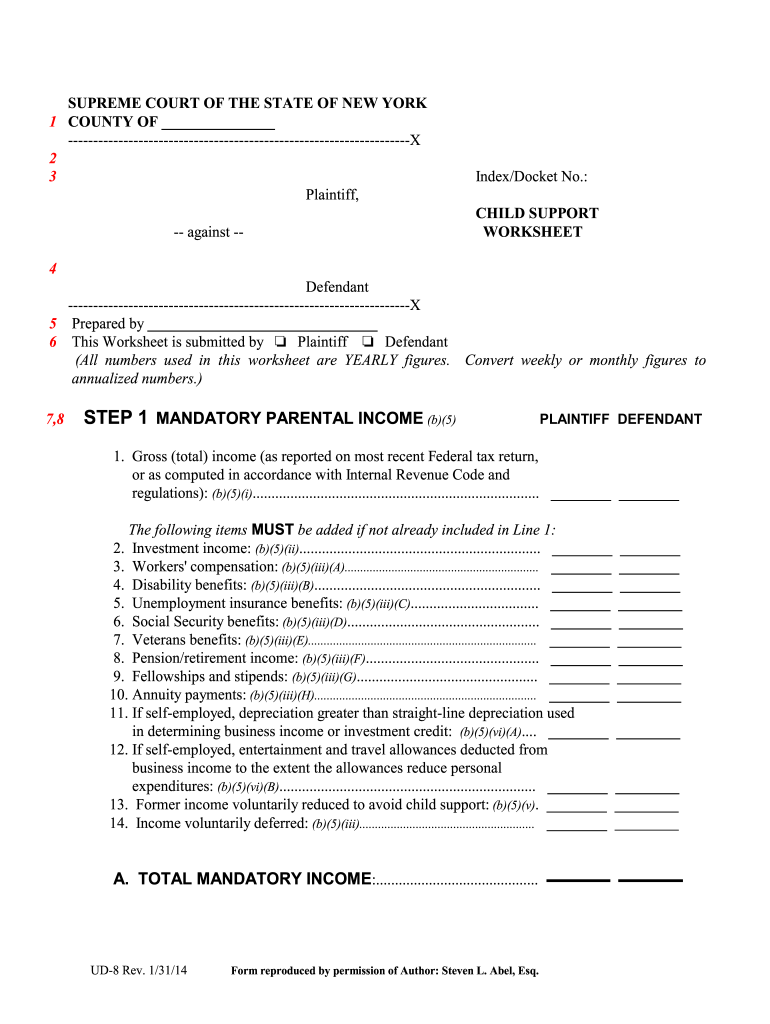

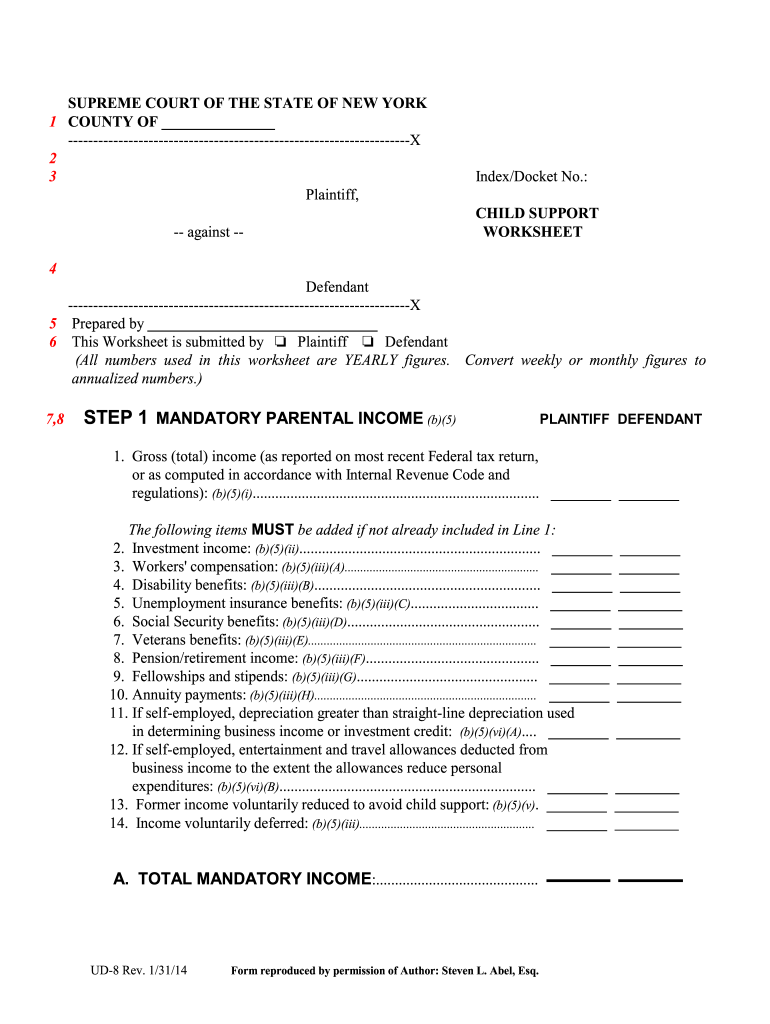

14. Income voluntarily deferred b 5 iii. A. TOTAL MANDATORY INCOME. UD-8 Rev. 1/31/14 Form reproduced by permission of Author Steven L. Abel Esq. SUPREME COURT OF THE STATE OF NEW YORK 1 COUNTY OF --------------------------------------------------------------------X Plaintiff -- against -- Index/Docket No* CHILD SUPPORT WORKSHEET Defendant 5 Prepared by 6 This Worksheet is submitted by Plaintiff Defendant All numbers used in this worksheet are YEARLY figures. Convert weekly or monthly figures...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ud 8 form

Edit your form ud 8 3 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ud 8 1 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ud 8 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ud8 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY UD-8 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ud8 form

How to fill out NY UD-8

01

Obtain the NY UD-8 form from the New York State Unified Court System website or your local court.

02

Fill out the top section with your name, address, and phone number.

03

In the second section, provide the name and address of the tenant being evicted.

04

Complete the details regarding the rental property, including the address and any additional information required.

05

Indicate the reason for eviction, making sure to reference the relevant laws or lease conditions.

06

Fill out the section regarding the date and type of notice given to the tenant.

07

Verify that all information is accurate and complete before signing the form.

08

Submit the form to the appropriate court when ready to proceed with the eviction.

Who needs NY UD-8?

01

Landlords seeking to evict tenants due to non-payment of rent or lease violations.

02

Property management companies handling evictions on behalf of landlords.

03

Legal representatives assisting landlords in the eviction process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NY UD-8?

With pdfFiller, it's easy to make changes. Open your NY UD-8 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit NY UD-8 in Chrome?

NY UD-8 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the NY UD-8 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NY UD-8 in minutes.

What is NY UD-8?

NY UD-8 is a form used in New York State for reporting specific information related to the sale of cooperative apartments.

Who is required to file NY UD-8?

The seller of a cooperative apartment or their authorized representative is required to file NY UD-8.

How to fill out NY UD-8?

To fill out NY UD-8, provide details such as the seller's and buyer's information, property address, sale price, and relevant transaction dates.

What is the purpose of NY UD-8?

The purpose of NY UD-8 is to ensure that proper records of the sale of cooperative apartments are maintained for tax and regulatory compliance.

What information must be reported on NY UD-8?

The information that must be reported on NY UD-8 includes the names and addresses of the seller and buyer, the sale price, and the date of the transaction.

Fill out your NY UD-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY UD-8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.